Pact Group (ASX:PGH) has announced a net profit after tax of $50 million for its 2021 half year results, up 44 per cent compared to $35 million in the previous corresponding period.

Previously, Pact Group reported $1.809 billion in revenue, down 1.4 per cent from the previous corresponding period for its 2020 full year results, with a statutory net profit after tax of $89 million for the year ending 30 June 2020.

The company attributed a “stable demand for packaging products” in Australia, New Zealand, and Asia as one of the reasons for the most recent results.

Its underlying EBITDA was up 13 per cent to $164.2 million from $145.4 million for the half year ending 31 December 2020, while revenue was up 1.1 per cent to $894.4 million.

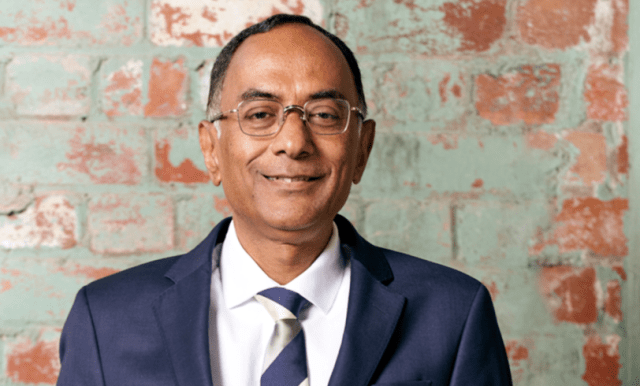

Pact Group managing director Sanjay Dayal said, “Our results in this period demonstrate a solid improvement in all key metrics. I am very pleased with the financial performance of the company in the period and the progress we are making in executing our strategy”.

In the packaging and sustainability segment, the business sae improved volumes in the agricultural, industrial, health and wellness sectors.

“Volumes in our Australian business have stabilised and with good progress in our turnaround activities, we are delivering improvements in our operational performance,” he said.

“We have seen strong earnings momentum in our materials handling and pooling segment with EBIT up 26 per cent driven by strong organic growth. We have delivered increases pooling penetration in the fresh produce sector, and the expansion of hangar reuse services in the US is progressing very well.

“Our contact manufacturing segment continued to benefit from strong demand for hygiene products early in the period. Pleasingly, demand for nutraceutical products in the health and wellness sector also improved. EBIT was up over 300 per cent and margins were strongly approved.”

Dayal also said that Pact Group continues to progress its strategy to lead the circular economy through reuse, recycling and packaging solutions. Several initiatives that were progressed include:

– Phase two of the Australian packaging turnaround, with market segment strategies developed and implementation underway

– Expansion of recycling capability, with the acquisition of Flight Plastics in NZ complete in January

– Growing the Asian packaging business, with renewal of major contracts in Asia

– Sale process in respect to its contract manufacturing business, which is ongoing and allegedly with a private equity group in Sydney

“We are progressing well in the execution of our strategy to lead in the circular economy. We are seeing improvements from the work completed on the turnaround of our Australian packaging business,” he said.

“Plastics recycling continues to be an exciting and rapidly evolving part of our strategy. With capabilities across the value chain, Pact is taking a leading role in developing plastics recycling infrastructure in Australia.

“Development of a domestic circular economy for plastics is a compelling opportunity to create value, improve job creation and deliver positive environmental outcomes.”

At the time of writing, Pact Group was trading at $2.80.