Over the past few decades, the global packaging industry has enjoyed healthy growth, supported by several megatrends. They will continue to shape the business, and we expect that two of them – sustainability and digital (particularly e-commerce) – will create significant challenges for industry leaders, as well as once-in-a-lifetime transformational opportunities.

To understand what lies ahead, we looked back at how the industry has adapted over previous decades. We found that since 2020, there have been three eras, including today’s, stretching into the immediate future. Each era has been characterised by large changes in consumer behaviour – changes that brought into existence new packaging products and other innovations that ultimately led to new corporate and value chain structures.

Significantly, as these three eras unfolded, the proliferation of digital devices and social media sped up the pace of change and influenced the type of disruption.

In the current era, a dramatic shift to online shopping, increased global regulation of packaging waste, and the acceleration of consumers’ sustainability concerns have combined to reinforce the rapid pace of change. If CEOs are to navigate this extraordinary disruption, next-generation industry winners must update and future-proof their business models and market approaches.

Context: Three disruptive eras in the global packaging industry

Packaging is a critical enabler for the everyday lives of most consumers. It helps to support the purchasing decision journey in retail stores, creates cost-efficient delivery systems for brand owners, minimises product breakage and food waste throughout the value chain, and facilitates the consumer’s need for convenience.

In 2019, we outlined five major trends we expected to change the game in the diverse $1 trillion-plus packaging industry: e-commerce, changing consumer preferences, margin compression, sustainability, and digitisation.

We predicted that these trends would raise the bar for performance over the next five to ten years.

In 2020, the COVID-19 pandemic made food safety and hygiene a sixth key industry-shaping trend.

Overall, the strategic importance of well-functioning and cost- efficient packaging materials for customers in the value chain accelerated, given the stretched supply chains of the pandemic. What now liesin store for the packaging industry during the next normal up to 2030? How can CEOs navigate these choppy waters?

To understand the future, industry leaders must consider where the packaging industry is coming from. Each of the three eras we identified (Exhibit 1) has been characterised by major changes in consumer behaviour (factor 1), which promoted innovation and the development of new packaging products (factor 2).

Changes in the market and global environment ultimately led to renewed corporate and value-chain structures as well (factor 3).

Era 1 (2000–09): Substrate shift changes

The headline changes during this era included the continued increasing use of flexible packaging and rigid plastics (such as PET plastic packaging) to replace rigids such as metal, paper, and glass.

The goals here were to accommodate the consumer’s demand for convenience – for instance, ready-to- eat, portability, and smaller (including single- portion) packs – to improve functionality, and to drive down costs.

From a corporate-structure perspective, this was an era of forced restructuring: several global diversified corporations divested noncore areas (such as packaging and graphic papers), and paper-packaging companies sold off upstream businesses (such as the ownership of forests).

Given the reality of mature growth in developed regions, European and North American corporations entered new high-growth ones (such as China, India, and Latin America), mostly through acquisitions or joint ventures, but also organically, as they followed the growth of their customers.

The great financial crisis toward the end of the era had a negative impact on packaging consumption and further accelerated the shift toward plastic packaging to manage cost pressures. The impact was mixed for different end-use areas, however: food and beverages are necessities, and thus their packaging was more resilient to the downturn; industrial and luxury-goods packaging was more sensitive to it.

Era 2 (2009–20): Changing face of the consumer

This era began with the uncertainty and disruption of the great financial crisis. Despite the overall economic challenges, most global packaging players emerged strong from the crisis: they enjoyed

steady growth from continued shifts in the choice of substrates (for example, retort pouches) and expansion in booming emerging markets.

During this era, China surpassed North America as the world’s largest packaging market. Despite the shift in the economic centre of packaging demand, European, Japanese, and North American companies remained in the industry’s top ten, given the high number of megamergers in Europe and North America and continued fragmentation in emerging markets. From a corporate-structure perspective, private-equity activity increased robustly.

Toward the end of the period, awareness of sustainability rose significantly: consumers began to turn against the leakage of packaging into the environment, and action to curb this problem became more common.

The movement against plastic straws, for example, increased consumer awareness of the potential dangers of single-use plastics. Policy makers reacted to the public outcry with a variety of responses, such as the European Union’s single-use directive, taxes on plastic bags, outright bans in many US states, and regulations on food service packaging in China.

Brand owners responded to this increased public and regulatory pressure by making bold commitments to reach full recyclability and to increase their usage of recycled materials. The use of non-plastic (such as metal-, glass-, and paper-based) substrates increased.

Although heightened pressure for sustainability generated a growing appetite for innovation, large-scale commercialisation was quite rare, partly because the packaging industry couldn’t find cost-effective and functional alternatives to plastic.

Era 3 (2020–): Sustainability and the digital transformation

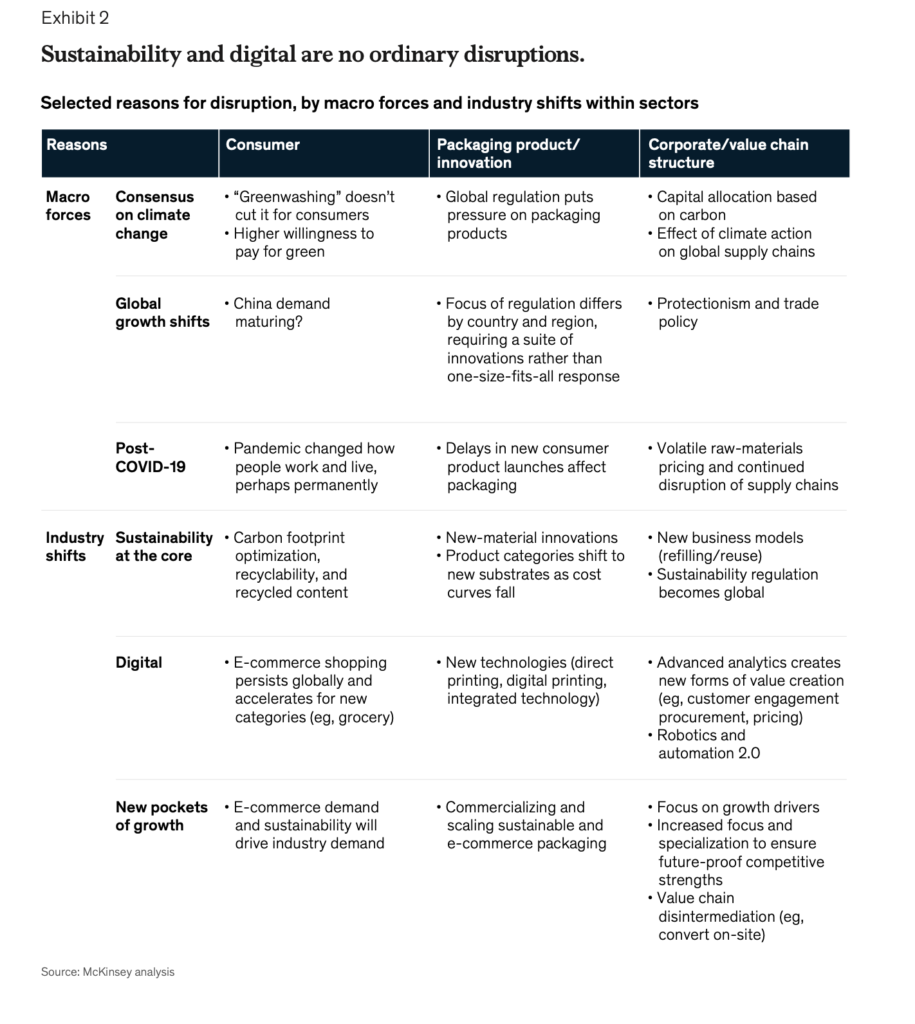

The era of transformational change is upon us, and the pace of change is accelerating rapidly. Sustainability and digital (particularly e-commerce) are the megatrends shaping this era (Exhibit 2), which will be the most disruptive so far, creating uncertainty, challenges, and opportunities.

For industry leaders, this disruption has two main aspects, the first from a customer-back perspective, the second from a product-forward one.

Above all, as new regulations emerge in response to global consumer concerns, “greenwashing”

doesn’t cut it anymore. Capital allocation is already – and will increasingly be – based on the sustainability and performance of businesses that will be focusing their attention through three lenses: decreased leakage, improved circularity, and a reduced carbon footprint. We therefore expect a more balanced understanding of true sustainability.

Meanwhile, as a result of this pressure, we now see stronger efforts to commercialise packaging innovations, as well as better marketing of their performance (for example, the carbon footprint printed on packages).

It will be important for innovative products to be not only more sustainable but also less expensive, so packaging converters will probably have to consider incorporating new materials, even new substrates, into their portfolios. These substrate shifts will return, but now with a larger pallet of available materials, both new and old.

Several category shifts can be expected over the coming years as cost curves come down in response to the higher production of new materials and as extended producer responsibility (EPR) and tax pressures make non-sustainable packaging more problematic.

We also expect that emerging business models and technologies for reuse and refilling will gain further acceptance and traction. However, none of these can be described as an easy win; they will require real market making to succeed.

Sustainability pressures will also create challenges for substrate players that rely on materials being phased out. As their products and assets become obsolete, their leaders will have to make an early strategic choice: either to be the lowest-cost, most efficient “last player in the game” or to dramatically reposition the portfolio. Waiting and riding out this transformational change is not an option.

CEOs ought to think about sustainability in a fully holistic manner. In addition to having a sustainable product portfolio, they should accelerate their programs to reduce greenhouse gas emissions both in operations and throughout the supply chain.

The other potent ingredient in this mix is digital, especially e-commerce. Increased online shopping is creating and expanding new avenues of packaging demand, especially for sustainable protective and transport packaging.

E-commerce will change the requirements fundamentally: packaging will be specifically tailored to it – designed for efficiency in the supply chain and for unboxing at home rather than for sitting on retail shelves.

In the next few years, ship-ready packaging will probably become a must for brand owners to manage cost and sustainability pressures. We already see e-commerce giants, as well as countries such as China, swiftly adopting standards to scale up the usage of this type of packaging, which ultimately could eliminate a significant amount of demand for secondary packaging.

Packaging isn’t the only issue raised by digital. In addition, it provides opportunities to improve the end-to-end customer journey, to manage the pipeline for new and current customers, and to measure the customer experience more fully and accurately.

From a corporate-structure perspective, CEOs should consider two components of change. First, companies will increasingly focus on growth drivers and spin off noncore businesses into new stand-alone entities.

Digital enablement is the other component – in customer engagement, internal workflows, the supply chain, manufacturing automation, and faster decision making. The packaging industry is still in the early stages of digitisation, but we expect it to become a clear priority and an important value creation lever, particularly in the current context of volatile raw-material markets and increased protectionism and trade policies, because digital can make supply chains transparent and promote excellence in procurement.

CEO priorities: Six key moves to navigate transformational change

The transformational changes of the immediate future will challenge many packaging players. Nevertheless, these changes will also offer real growth opportunities for organisations pursuing the right focus and actions.

How should CEOs of packaging companies manage in this new environment? The first requirement is

to build resilience. Our research on the last recession found that some companies – the resilient ones – generated excess total shareholder returns (TSR) during the downturn and the recovery.

Resilient companies have some distinctive characteristics in common, which enable them to emerge strong during the recovery phase. An important one is focusing on growth by focusing aggressively on resources: for example, doubling their reallocation to key growth areas. So is innovation, including new business models and capabilities.

Another vital and trade policies, because digital can make supply chains transparent and promote excellence in procurement.

CEO priorities: Six key moves to navigate transformational change

The transformational changes of the immediate future will challenge many packaging players. Nevertheless, these changes will also offer real growth opportunities for organisations pursuing the right focus and actions.

How should CEOs of packaging companies manage in this new environment? The first requirement is to build resilience. Our research on the last recession found that some companies – the resilient ones – generated excess total shareholder returns (TSR) during the downturn and the recovery.

Resilient companies have some distinctive characteristics in common, which enable them to emerge strong during the recovery phase. An important one is focusing on growth by focusing aggressively on resources: for example, doubling their reallocation to key growth areas. So is innovation, including new business models and capabilities.

Another vital factor is to rebuild the portfolio through acquisitions while also restructuring costs from a position of strength (for example, by driving down sourcing costs and using automation).

In the context of today’s era of disruption, transformational change in markets, and increasing volatility, these are the six priority moves that industry leaders can use to create resilience, capture growth, and navigate transformational change:

1. Sustainability: Invest where it matters to consumers and regulators.

2. Growth: Win by identifying granular pockets of opportunity.

3. Procurement and the supply chain: Use strategic category management to get ahead of inflation and supply headwinds.

4. Pricing excellence: Recapture inflation and use it to capture margins.

5. Talent: Attract, retain, and retrain employees, and get the return to work right.

6. Digital and e-commerce: Embrace digitization (including the use of automation) in the front, back, and middle of processes.

None of these involves wholly new territory. In fact, a few are about going back to the basics – for example, retraining the talent base to fill critical capability gaps in sales and procurement. Companies will have to carry out these moves against the backdrop of the current external environment (labour shortages, working from home) and the new tools and technology available (for instance, automation).

From a growth perspective, the performance and attractiveness of subsegments (such as specific combinations of substrates, geographies, and end uses) will continue to vary significantly. Winners should identify and move into the most attractive segments by tailoring a granular market approach.

CEOs of packaging companies should address the six moves holistically and in combination. All six require action and urgency. Trying to ride out the transformational changes ahead by hunkering down will not work.

Change often emerges gradually and then accelerates suddenly. CEOs of packaging companies must treat the higher volatility of their markets as a new normal in this era of transformational change.

Corporations that fail to address the real issues will face significant uphill struggles and risk going out of business or being acquired. Resilient and successful companies will embark upon the next level of value creation.

David Feber is a partner in McKinsey’s Detroit office. Oskar Lingqvist is a senior partner in the Stockholm office. Daniel Nordigaarden is a partner in the Toronto office. Matthew Seidner is a partner in the Chicago office. This story was republished with permission.